Money mindset, and the connection with mental health

Our backgrounds and mindset can have a big impact on the financial decisions we make, and why.

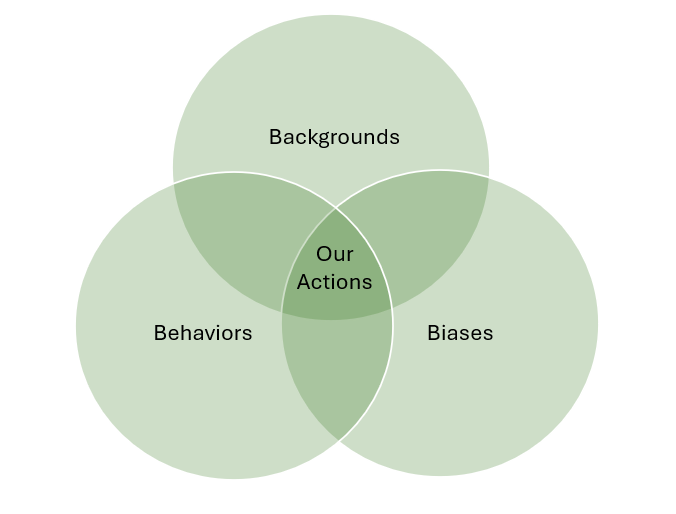

There is a lot on the subjective front that influences how we feel about finances, whether we are aware of it or not. We bring in our personal history and ways of thinking to this, as we do any other aspect of our lives. We call these the “three B’s” – Backgrounds, Biases, and Behaviours, that all combine to form the decisions and actions we take.

Backgrounds

While every person is unique, there are some observations we can make from our studies of different groups.

For example, in some cultures it is not common for women to be invited into the conversation on financial topics as it’s seen as something for the men in the family. In those cultures, we’ve found women aren’t given as much education on financial wellness or they are less confident in their handling of it.

In other cultures, we’ve seen the family be more involved in finances, so discussions should involve the broader family, not just you as employees at your company.

Biases

We also have personal biases (or preferences) that we bring into the discussion, some of which we don’t know are in action (these are often referred to as “unconscious biases”). Some examples would include:

- Bad habits – we all have them! For some, it could be spending too much money at the coffee shop rather than buying beans in bulk from the supermarket and making the coffee yourself at home.

- Short-term focus – we often overestimate what we can do in the short term but underestimate what we can do in the long term. Put another way, we want to see big changes now and are impatient for the cumulative impact of small changes. We don’t persevere when we don’t see immediate impact.

Behaviours

Our behaviours are driven by what we call our “executive functions”. These include:

- Flexible thinking.

- Self-awareness – knowing what and why we’re thinking and acting the way we are (instead of auto-pilot).

- Impulse control – how quickly and in what manner we react when issues emerge.

- Organisation – how you arrange and track things in your financial life.

How financial health and mental health are linked

Let’s now talk about finances and mental health. The biggest link between the two is emotion.

Financial stresses have been shown to lead to mental anxiety – a Fidelity study on mental health in the workplace show that people with high levels of concern about both their finances and physical health were least likely to be in good mental health. On the flip side, people with low levels of concern about their finances and physical health were most likely to be in good mental health.

Going the other way, if we’re mentally stressed, we can make poor financial decisions. We can give in to temptations, including buying unnecessary things, to try deal with the negative emotions.

Lastly, money problems tend to impact relationships negatively, which adds to poor mental health outcomes.

While we would like to take all emotion out of financial decision making, it’s not really possible in the real world.

With the seemingly constant turmoil in the world, many people feel that the world is happening to them. They feel powerless to take action. Removal of agency is a key depressor for many people – we are down when we feel that we have no choices. So, taking it back, even to a small degree, can impact our mental health significantly.

In summary

Each of us brings our own unique personality and perspectives to financial planning even before getting into the details. Try to be conscious of these as you engage with your financial planning and decisions.

1225634.1.0